Today, K-Beauty is a multi-billion-dollar global force that is reshaping the way we think about skin health, beauty rituals, and even product design. Around the world, consumers are swapping traditional routines for glass-skin goals, multi-step regimens, and playful, ingredient-focused formulas.

What began as a regional trend has now matured into a cultural and commercial powerhouse, driven by the K-Wave (Hallyu), propelled by digital virality, and sustained by relentless innovation. Whether you’re a beauty giant like L’Oréal in France, a luxury retailer in Dubai, or a local startup in Brazil, the impact of K-Beauty is impossible to ignore.

The cultural power of the K-Wave

Understanding the K‑Wave: Korea’s Cultural Domination

Before K‑Beauty ever touched French pharmacy shelves, Korean culture was already making waves across the globe, through K‑pop, K‑dramas, fashion, and food. This phenomenon, often called the Hallyu or Korean Wave (K‑Wave), has reshaped global youth culture:

- K‑Pop Influence: Groups like BTS, Blackpink, and NewJeans don’t just sell music, they sell looks. Flawless, dewy skin and vibrant makeup styles seen in music videos become product trends overnight. And they can become ambassadors or collaborate with skin care or makeup brands.

- K‑Drama Skin Standards: K‑Dramas are immensely popular on Netflix France. Series like Crash Landing on You or The Glory feature actors with impeccable skin, setting the gold standard for beauty.

- Aspirational Aesthetics: The “glass skin” or “chok chok” glow has become aspirational among French consumers, especially Gen Z.

- Soft Power Success: Korean culture is tightly packaged with values like wellness, minimalism, skincare-first beauty, and social engagement—all of which resonate with modern, global consumers.

Jennie (Blackpink) for Hera & Mingyu (Seventeen) for Innisfree

The rise of K-Beauty

The case of France

South Korea’s cosmetics exports smashed through the US $10 billion barrier in 2024, rising 20.6% year on year. This performance has cemented the country’s position as the third-largest cosmetics exporter worldwide, behind only France and the United States. While precise figures for early 2025 exports to France are not officially available, European demand is undeniably accelerating. Markets such as Poland, the UAE, and Indonesia have already recorded growth rates of over 70%, and France is experiencing a similar surge in imports and consumer demand, with Korean skincare steadily moving from niche appeal into the mainstream.

The French case offers a telling illustration of this global trend. Once confined to online specialty shops, K-Beauty products are now deeply integrated into everyday retail environments. In Monoprix, Korean skincare brands appear alongside household names in curated displays designed for mass-market shoppers. On the more luxurious end, Parisian department stores such as Galeries Lafayette, Printemps, and BHV have established permanent sections dedicated to Korean beauty, underscoring its prestige positioning. Printemps just opened a pop-up with Shinsegae, South Korea’s leading luxury retailer, which became a launchpad for emerging K-Beauty and lifestyle brands. Even the pharmacy channel, dominated by dermo-cosmetic staples like Avène or La Roche-Posay, has opened its doors, with Torriden’s debut at Pharmacie Lariboisière marking a symbolic entry point for Korean skincare into one of France’s most trusted retail categories.

Announcement of k-beauty products in Monoprix France.”K-beauty has arrived. We’ve scoured Seoul to find the very best for you.”

Pop up Shinsegae x Printemps in Paris

Far from being an isolated case, this mainstreaming of K-Beauty in France reflects what is happening across the world: Korean products are moving from niche curiosity to everyday presence in mass retailers, department stores, and pharmacies alike. The trajectory confirms that K-Beauty is not just a passing trend but a structural force reshaping the global beauty landscape.

Consumer Shifts

Consumers around the world are increasingly drawn to K-Beauty because it offers something that feels both accessible and aspirational. One of its strongest appeals lies in the balance between affordability and effectiveness. Unlike many Western luxury products, Korean skincare delivers visible results at prices that younger shoppers and first-time skincare enthusiasts can justify, making it an inclusive gateway into advanced routines.

“For young Koreans, skincare must deliver results : fast, effective, and in true ‘ppali-ppali’ style.” – Olivier Mouroux, CEO Asiance

‘ppali-ppali’ : ‘quick-quick’

Another factor is the use of distinctive ingredients rarely highlighted in European or American formulations. Snail mucin, fermented rice water, ginseng, and mugwort extracts may sound unusual at first, but they have become synonymous with K-Beauty’s reputation for innovation. These natural yet scientifically validated elements promise hydration, barrier repair, and anti-aging benefits, and they have fueled countless viral conversations online.

Packaging plays its part as well. K-Beauty’s design language oscillates between playful and minimalist, appealing to both those who love Instagram-worthy bathroom shelves and those who prefer a clean, clinical aesthetic. The result is a category that feels approachable without compromising on credibility.

Example of K-beauty’s minimalist packaging

Finally, the industry thrives on viral momentum, amplified by TikTok, Instagram reels, and the global influence of K-Pop idols. A single clip showing a glowing complexion after applying a serum can sell out thousands of units overnight. This fusion of pop culture and digital marketing has transformed K-Beauty products into more than skincare, they become lifestyle statements.

The K-beauty in the US

The United States has become one of the most dynamic frontiers for K-Beauty’s global expansion, with New York City emerging as a symbolic hub. On May 17, 2025, the Korean brand Fwee opened its first U.S. retail store in SoHo, marking a new chapter for K-Beauty’s brick-and-mortar presence in the American market. This physical expansion is complemented by a series of pop-up experiences, such as The Best of K-Beauty IRL curated by PlayLab, which has traveled from Los Angeles to New York with the goal of demystifying Korean skincare routines for curious American consumers. These events illustrate how K-Beauty is no longer a niche import but a cultural experience designed to meet shoppers where they are.

Fwee first US store in NYC

At the same time, online-first platforms like Soko Glam, Peach & Lily, and Ohlolly continue to anchor K-Beauty’s digital footprint, fostering loyal communities through education, curated selections, and storytelling. Even retail giants like Amazon have recognized the demand, dedicating entire pages to K-Beauty products.

The role of influencers and reviewers in the U.S. mirrors the strategy that fueled K-Beauty’s rise elsewhere. Figures such as Christine Chang, Liah Yoo, and Soo Beauty have built large audiences by sharing routines, honest reviews, and product breakdowns, helping American consumers navigate a skincare philosophy that is both familiar and refreshingly different. Their content often bridges cultural gaps, translating Korean innovation into practical tips for everyday American routines.

Ultimately, what sets K-Beauty apart in the American market is its different approach to beauty itself. While Western cosmetics have long been associated with correcting imperfections, Korean skincare emphasizes prevention from an early age. The philosophy is to protect and nurture the skin barrier before problems arise, while still offering effective corrective solutions when needed. For American consumers increasingly drawn to wellness and holistic self-care, this “prevention-first, skin-first” philosophy has proven to be a compelling alternative to traditional beauty narratives.

Where and How K‑Beauty Is Winning

Omnichannel Retail Domination

K-Beauty’s retail strategy has evolved into full omnichannel domination, blending physical presence with digital reach in ways that few other beauty categories have mastered. In Paris, department stores such as Galeries Lafayette and Printemps now dedicate entire corners to Korean brands, creating a permanent showcase for the country’s skincare innovation. These spaces are more than simple points of sale, they are immersive experiences that place Korean products side by side with established French luxury houses, signaling their arrival as equals in prestige.

Beyond permanent counters, the rise of pop-ups and treatment bars adds another layer of consumer engagement. Spaces like Glowstation and Maison Kōsane in Paris invite shoppers to experience K-Beauty not just as a product purchase, but as a lifestyle ritual. These hybrid formats mix retail with education, offering facials, personalized consultations, and product discovery zones that turn curiosity into loyalty.

Maison Kōsane store in Paris, Bon Marché.

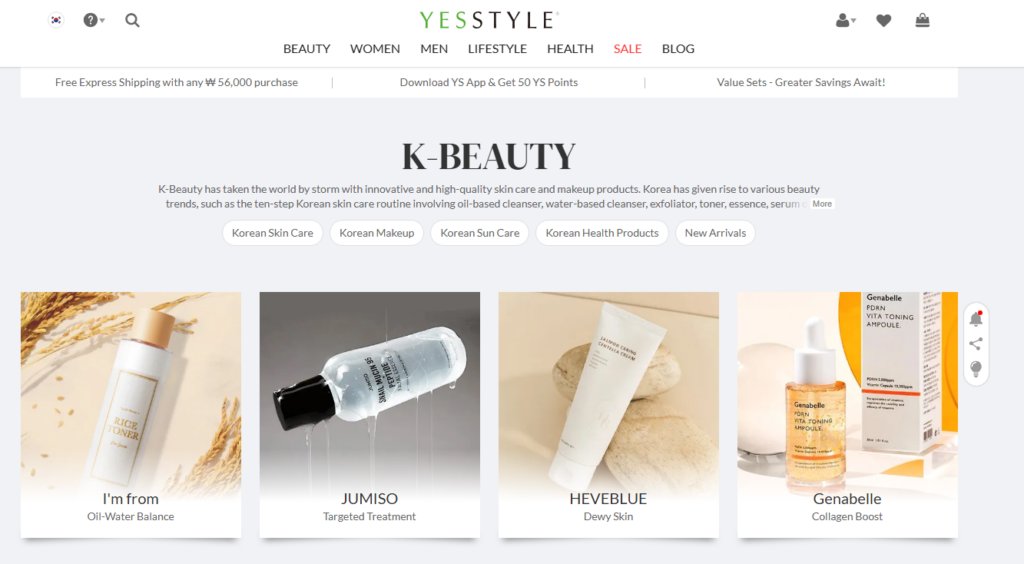

At the same time, online-first platforms remain a critical distribution channel. Sites like YesStyle, Stylevana, and Jolse have been instrumental in introducing global consumers to Korean skincare long before mainstream retailers embraced it. Even now, they serve as hubs for hard-to-find products, seasonal releases, and routine bundles, often at competitive prices. This dual strategy ensures that K-Beauty reaches both casual shoppers and dedicated enthusiasts wherever they prefer to shop.

Yesstyle web page, k-beauty section

Digital & Viral Appeal

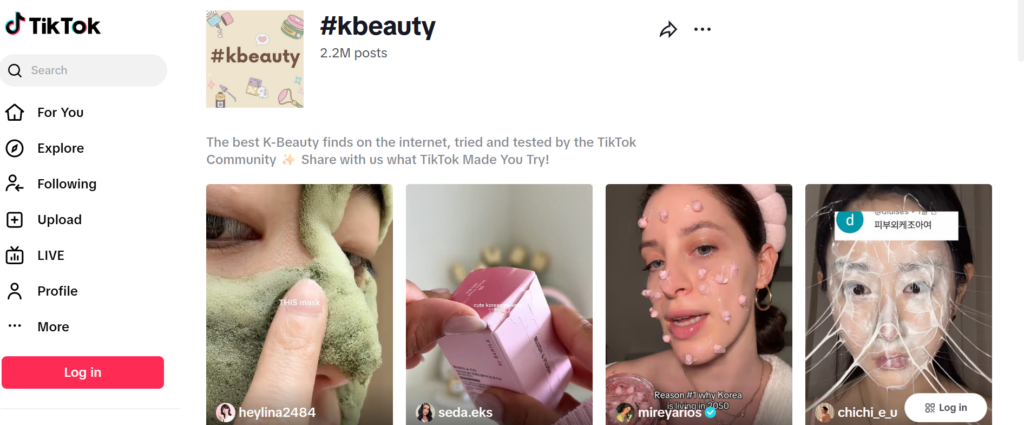

TikTok Takeover

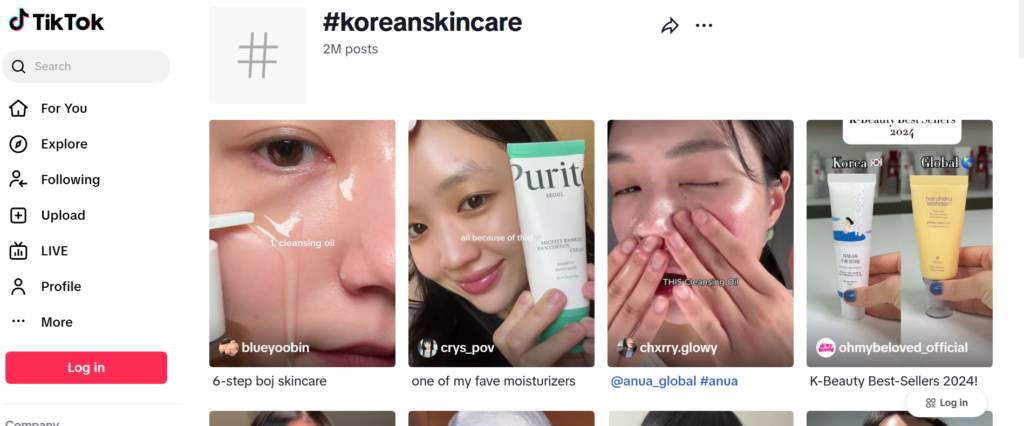

Few industries have leveraged TikTok as effectively as K-Beauty. Hashtags like #kbeauty and #koreanskincare now count in the billions of views, creating a digital megaphone that reaches Gen Z and millennials across continents. Trends such as “slugging,” toner pads, and 10-step routines spread in days, fueled by short, visually satisfying videos that promise instant results. Korean brands have learned to design with virality in mind: Beauty of Joseon’s Relief Sun SPF50+ and COSRX’s Snail Mucin Essence are perfect TikTok products: affordable, photogenic, and delivering visible results that translate beautifully on camera. The result is a formula where a single viral video can trigger global sellouts within hours.

#koreanskincare #kbeauty on Tiktok

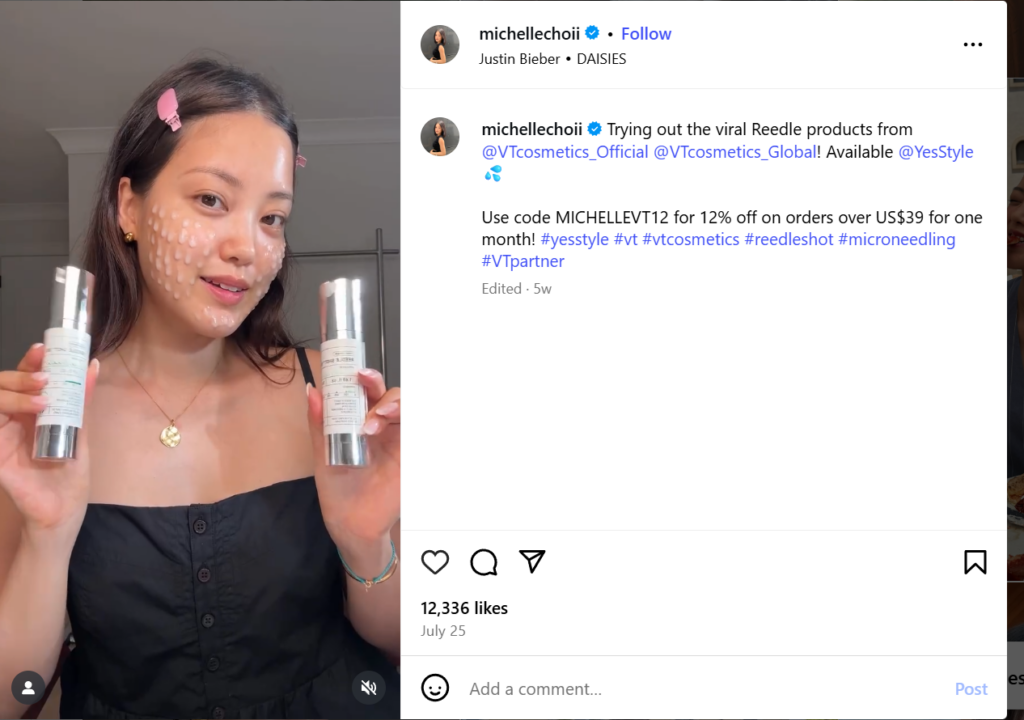

Influencer & Micro-Influencer Ecosystem

A key reason K-Beauty thrives online is its reliance on authentic, grassroots content. Influencers across the world post “first impressions,” “before-and-after” transformations, and “routine breakdowns” that demystify products for new audiences. This network is truly global: in the U.S., micro-influencers like @Michellechoi helped propel Korean skincare into mainstream consciousness by spotlighting their textures and clean formulas, while in France, reviewers such as @SkinbyJulie or @KoreanRoutineParis translate routines, compare products, and adapt recommendations to local skin types and climates. Together, this ecosystem creates a web of trust that accelerates cross-border adoption.

@michellechoi on instagram

Seamless Path to Purchase

The virality of K-Beauty would be incomplete without a frictionless shopping experience. TikTok posts and Instagram reels often come with affiliate links, discount codes, or direct shopping tags, allowing viewers to purchase instantly on global platforms like YesStyle or Amazon, or even local retailers such as Sephora in the U.S. and Monoprix in France. This seamless path to purchase transforms curiosity into conversion almost immediately. Sudden demand spikes are common, a viral video can empty online inventories and pharmacy shelves in a matter of days, fueling hype and scarcity. At the same time, direct-to-consumer brands like Yepoda in Europe have polished the online experience further with French-language websites, free shipping, and minimalist branding that speaks directly to Western sensibilities.

Innovation as a Competitive Weapon

When it comes to innovation, K-Beauty and French brands embody two very different philosophies. Korean companies are known for being fast, experimental, and highly responsive to consumer demand. French brands like L’Oréal, in contrast, are lab-based, methodical, and deliberate, preferring long research cycles and rigorous testing before bringing a product to market. The result is that France projects scientific authority and stability, while Korea conveys agility and freshness.

This difference extends to packaging. K-Beauty often adopts playful yet functional designs, ranging from brightly colored sheet masks to sleek, stackable bottles that fit perfectly into a multi-step routine. French houses, however, stay closer to premium and traditional aesthetics, emphasizing elegance, minimalism, and luxury cues such as glass jars, embossed logos, and metallic accents.

Finally, the brand stories diverge just as sharply. K-Beauty is youthful, pop-culture infused, and globally connected, riding the momentum of K-pop, K-dramas, and the larger Korean cultural wave. French brands, by contrast, emphasize heritage, science, and Parisian luxury, leaning on decades of tradition. These two narratives appeal to different consumer instincts: one offers novelty and cultural excitement, the other offers trust, prestige, and timeless authority.

The L’Oréal Response

Strategic Moves

Global beauty giants, and especially French groups, have not stood idle in the face of K-Beauty’s meteoric rise. In recent years, they have taken concrete steps to tap into Korean innovation and cultural capital rather than risk losing relevance. A telling example came in 2024, when a major French player acquired Dr.G, a well-regarded Korean dermo-cosmetic brand known for its clinical yet accessible formulas. The same year saw an investment in Born to Stand Out, a Korean fragrance startup that reflects the experimental, youth-driven edge of Seoul’s beauty scene. Beyond acquisitions, initiatives such as the “KO-Creation” program have been launched to foster co-innovation with Korean laboratories, allowing French conglomerates to blend their scientific expertise with Korea’s agility and trend-setting instincts.

Shift in Strategy

These partnerships go hand in hand with a noticeable shift in strategy among French brands. Traditionally cautious and slow-moving, they are now compressing their R&D cycles to respond more quickly to emerging skincare trends, mirroring the rapid product turnarounds that have long defined the Korean market. At the same time, packaging and marketing strategies are being overhauled to fit a social-first reality, with Instagram and TikTok aesthetics influencing design as much as traditional luxury codes once did. Finally, the focus of product development is being recalibrated to align with Gen Z and millennial skincare habits : a demographic that prioritizes skin health, playful routines, and authenticity over prestige alone.

What’s Next for K‑Beauty in France and in the world?

Looking ahead, K-Beauty’s influence shows no signs of slowing. In France, the category is expected to gain even more visibility in pharmacies and professional salons, two highly trusted spaces where French consumers often turn for skin expertise. What was once limited to department store corners is now making its way into everyday points of purchase, signaling a deeper integration into mainstream beauty culture.

Globally, the rise of hybrid skincare-makeup lines, such as tinted sunscreens, cushion foundations with SPF, or serums that double as primers, will likely become the norm rather than the exception. This reflects a shift in consumer habits toward multitasking products that save time while enhancing skin health, a philosophy that K-Beauty pioneered and Western brands are now racing to adopt.

At the same time, French beauty houses are increasingly aware that they must adapt or collaborate with Korean brands to maintain cultural relevance. Whether through acquisitions, co-branded collections, or technology-sharing programs, the boundary between competition and partnership will continue to blur.Finally, the sustainability and clean-beauty movement will deepen K-Beauty’s global impact. Korean brands are already innovating with refillable packaging, vegan formulations, and eco-friendly sourcing, areas where French maisons have traditionally emphasized luxury over environmental responsibility. As younger consumers prioritize ethics alongside efficacy, K-Beauty’s agility in this space could once again set the pace for the rest of the industry.

Curious about our services ? Contact us at insight@asiance.com to craft innovative marketing strategies and engaging brand experiences that resonate with your audience!